National Kidney Foundation Donation Pick Up Area

The National Kidney Foundation thrift stores are located all around the country. Donation pick up areas depend on the location of the National Kidney Foundation branch near you. Donation Town is your resource for setting up a National Kidney Foundation donation pickup in your community. Make a free Kidney charity clothes donation pickup appointment online today!

The Tax Receipt And A Copy Of The Title Is Key

Documentation is key. Its important that youve signed your title over correctly to the National Kidney Foundation of Utah. Whether they recycle, or auction off your car. IRS Publication 4303 has more details. So be sure to keep copies of your title and the tax receipt . Youll need them at tax time.

If theres a delay in getting the car sold between the end of one tax year and the beginning of another , you can ask the IRS for a six-month extension or later amend your IRS 1040 from the previous year. Another option is to file on time, claiming only the minimum up to -but not more-than $499as stipulated by the IRS rules. Lastly, there is no obligation for donors claim the deduction for a car donation. The charity and kidney patients have still benefited from your generosity, regardless of your tax filing.

What Vehicle Donors Are Saying

Donors Share Their Experience with Donating a Vehicle:

“I wanted to take a moment to email the two of you to express how easy this process was to donate my car… took the time to answer all my questions, allowed me to contact directly when I had follow-up questions, and even helped me by phone fill out the necessary forms that I needed to complete the transaction with the DMV.” – Monica M.

California Office

4669 Murphy Canyon Road, Ste.200

San Diego, CA 92123

All donations will be a charitable benefit to one of thousands of our nonprofit partners and CARS , a 501 nonprofit that provides transportation solutions for seniors.

You May Like: What Std Messes With Your Kidneys

What Are The Tax Forms You Need To Fill Out

Various tax forms are required based on the value of your donation. If youre claiming a deduction of $500 or less, you must keep the charitys written acknowledgment of your vehicle donation together with your tax paperwork.

If youre claiming a deduction greater than $500 but not exceeding $5,000, you must attach the same document as well as the completed Tax Form 1098-C to your tax return. Plus, you are required to complete Section A of Tax Form 8283 .

If youre claiming a deduction greater than $5,000, you must attach completed Section B of Tax Form 8283 . You may also be required to obtain a written appraisal of your vehicle.

We recommend that you consult a tax advisor or the IRS for more specific information about charitable contributions.

Best Places To Donate Your Car To Charity

-

Date

Donating your used car to charity is a convenient way to dispose of an old vehicle while reaping tax benefits.

According to New York-based salvage company Cash Auto Salvage, charities recycle nonworking vehicles for their scrap metal and parts, potentially bringing in a few hundred dollars for a charity. But according to vehicle paint meter manufacturer FenderSplendor, working vehicles bring in even more. Charities sell them at auction for anywhere from $300 to $3,500 on average.

Plus, donating your vehicle lets you skip the hassle of trying to sell the car yourself while still allowing you the financial benefits of tax deduction. In fact, the most challenging part of car donations is finding the right charity to donate to.

Read Also: Kidney Medical Term

Donate Running Or Non

National Kidney Foundation of Hawaii

With over 200,000 Hawaii residents at serious risk of afflicted by kidney disease, your truck donation on Oahu helps us reach out to thousands of families each year. As we continue to increase and expand our programs and services that focus on preventing kidney disease and providing support for our kidney patients and their families, every truck donation on Oahu makes a difference.

You may have heard that tax laws have changed, but one thing remains the same – DONATING YOUR TRUCK IS STILL A GREAT WAY TO GET A GREAT TAX DEDUCTION. Here at the National Kidney Foundation of Hawaii, we care about our donors and we are taking every step necessary to get you the best tax deduction possible.

We look forward to hearing from you and thank you again for supporting the National Kidney Foundation of Hawaii.

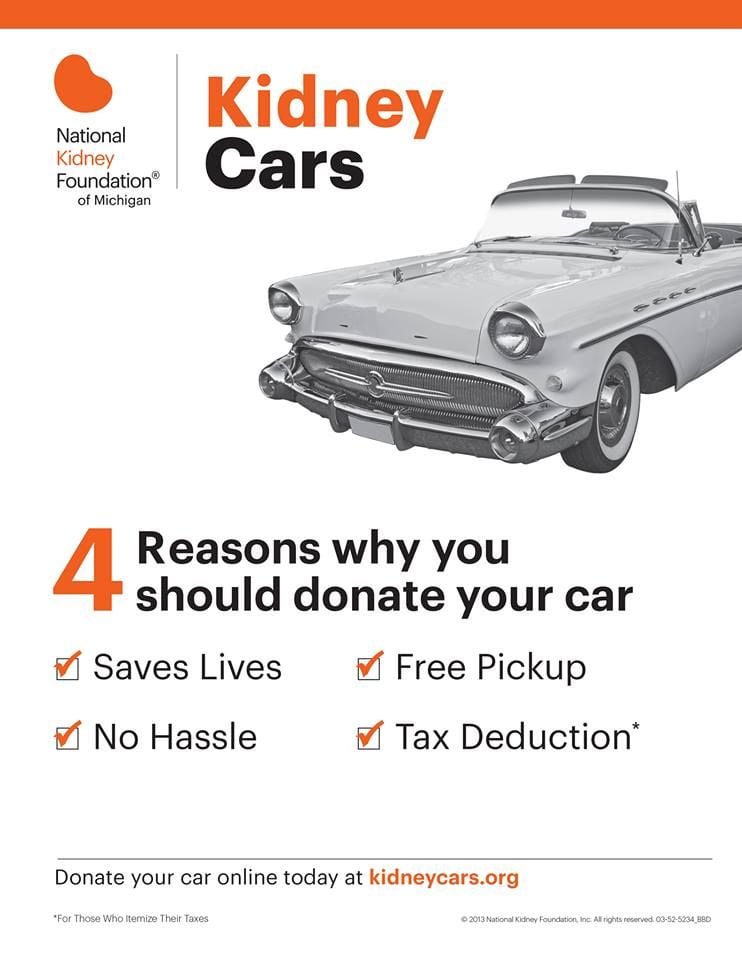

Tax Deduction

As of January 1, 2005, the maximum tax deduction you can receive without needing notification of the Gross Selling Price of the truck sells for more than $500 and you itemize on your taxes when you may claim the GSP as the deduction. NKFH will provide notification of the tax deduction within 30 days of the sale. NKFH cannot guarantee any selling price for any truck. It may take up to 60 days or longer to sell your truck and for you to receive notification of your tax deduction.

**Every donor will receive sale notification. Even if the selling price is less than $500, you may still take the maximum tax deduction of $500.

How To Donate Your Car

The easiest way to donate your car is to simply contact a charity and arrange for it to come pick up your vehicle. Many of the larger charities like Habitat for Humanity, Goodwill and the Salvation Army offer dedicated services for this, complete with phone hotlines and websites with donation forms. There are even dedicated car donation services like Charitable Adult Rides & Services, which handles all of the details and lets you choose the charity youd like the proceeds to go to.

If youre up for a bit more work, another option is to simply sell the car yourself and donate the money. In some cases this can be more beneficial to the charity, since you may be able to sell it yourself for more than the charity could get at auction for it. At the end of the day, its your choice.

Don’t Miss: Can You Have 4 Kidneys

How Much Will I Receive As A Tax Deduction For My Car

Your deduction depends on the sale price of the vehicle. The National Kidney Foundation strives to bring in the highest price for your donation, selling each car in a competitive bidding environment.

You can deduct the value of your vehicle only if you itemize deductions when filing your taxes. Under the current IRS law, you may only deduct the actual sale price of your vehicle or $500 whichever is greater. A receipt indicating the sale price and date will be sent to you within 30 days from the date of pick up. For more information, please visit the following link and refer to the documents listed below:

Car Donation Also Benefits You

Car donation is an excellent way to show your appreciation to the veterans who have fought for our freedom and it also provides you with many great benefits as well. Whether you live in Salt Lake City, West Valley City, Provo, Saint George, or West Jordan, your vehicle donation will be picked up or towed away at absolutely no cost to you.

Don’t Miss: Can Seltzer Water Cause Kidney Stones

Donate Now And Make A Difference

Your used car donations make a difference to the charity that matters most to you. With hundreds of charities partnered with our program, you can choose almost any registered Canadian charity to gift. We will ensure their receiving process is easy as well.

There are no fees charged to the charities at any time, so they can put each of your donation dollars to the good work they are doing on behalf of Canadians like you.

You Will Get A Tax Break

Did you know that being charitable also gives you some tax benefits? If you donate a vehicle to a kidney foundation, it qualifies as a deduction if your current tax status allows. The Internal Revenue Service consents to a tax deduction of up to five hundred dollars, as per the IRS Donors Guide to Vehicle Donation. You can ask your tax advisers about your personal tax benefit to check if you are qualified.

You May Like: Can Apple Cider Vinegar Affect Your Kidneys

You Can Always Sell Your Car And Donate The Cash

Besides giving your car directly to a charity, there is another way your vehicle can help a charity and maximize your tax benefits: You can sell the car yourself and donate the proceeds. If you know your cars history, and are a great salesman, you might be able to generate more cash than if you let the charity sell it.

Getting rid of a junker helps the National Kidney Foundation of Utah provide hundreds of thousands of dollars a year to carry out its mission providing health and human services to Utah and Idaho kidney patients with out of pocket medical expenses . Giving a car to charity will also make room in your garage for a new car :). So its important to keep in mind, if your focus is getting rid of a junker with minimal effort and youd like a tax deduction as a nice bonus, then donating your car is worth it!

Also Check: When Can You File Your Taxes

We Make Donating Your Vehicle Easy

Hours of Operation 5:00am – 7:00pm , Mon – Fri 6:00am – 5:00pm , Saturday

There are only two main requirements for donating a vehicle:

If you have any questions about whether your vehicle qualifies for donation, please give us a call at 855-3-KIDNEY

Recommended Reading: Does Red Wine Cause Kidney Stones

Schedule The Vehicle Pickup

Once you have submitted all the information needed, well schedule the vehicle pick-up at no cost to you. In most cases, you will be contacted within 2-3 business days to set a convenient appointment time for the pick-up. Please let us know if a rush pick-up is needed.

Please wait to sign the title transfer until the tow vendor arrives. They will provide guidance to make sure everything is completed correctly. Once your vehicle has been picked up, the tow operator will provide a donation receipt which will act as a tax receipt if your vehicle sells for less than $500. If your vehicle donation sells for more than $500, an IRS Form 1098-C will be provided as well.

Please be sure to remove all personal belongings from the vehicle. If your vehicle is titled in Arizona you will remove the license plate and keep it with you.

Additional Ways To Leave A Legacy

Gifts such as a Charitable Remainder Trust can be considered as a potential option for your family. These gifts can provide tax benefits combined with annual income for the donor. The National Kidney Foundation will work with you and your advisor if you are interested in this option.

For further questions about donating to the National Kidney Foundation of Michigan contact Lisa Schutz-Jelic at .

Read Also: Blood In Kidney Causes

Irs Car Donation Rules To Be Aware Of

For a car donation to be eligible for a tax benefit, the vehicle must be donated to a tax-exempt nonprofit organization that falls under IRS section 501 which can receive tax-deductible donations. At Donate A Car, we have already done the work for you in providing a large list of trusted charities that meet this requirement. You can rest assured that whichever nonprofit organization you choose on our site to benefit from your car donation, that they are allowed to receive tax-deductible donations.

After your donated car is sold at auction, you will receive an IRS Tax Form 1098-C in the mail providing the amount you are allowed to deduct on your taxes.

Youve Got Questions Weve Got Answers

How do I donate my car?

You can donate your car, motorcycle, motorhome or boat online. Simply fill out the online donation form and you will be contacted within two working days to arrange pickup or delivery.

How quickly can you tow away my car?

It typically takes 24-48 hours after the Kidney Foundation receives your information. To assure the best possible service, we ask donors to contact our office if the donated vehicle is not towed away within 3 days.

Will you take my car?

We accept any car that has a clear title, inflated tires, and has not been dismantled/parted out. We can tow your vehicle from almost anywhere. For rural locations, call our office at 1-800-869-5277.

What about the tax deduction?

The tax deduction generally applies to those who itemize deductions on their 1040 federal tax return. The amount of the tax deduction depends on the actual sale value of the Kidney Kar donation.

You are allowed to claim a fair market value up to $499 unless the vehicle sells for $500 or more. If your Kidney Kar donation is sold for more than $500, you can claim the actual sale value as your deduction. Please check with a tax professional regarding your personal tax benefit.

IRS Links for you and your tax advisor:

Also Check: Can Seltzer Water Cause Kidney Stones

You Have An Unwanted Car In The Garage

Whether you have a car, truck, motorcycle, or even a boat, you know that it does not last forever. There are several reasons for an unwanted vehicle. You could have outgrown your need for it because of a new one. It could also be possibly decades-old already and is just fodder for rust under your car porch. Whatever the reason, you know that selling it on your own will be very difficult, especially if the motor is not running anymore.

So if you have a car that is just occupying space, then donating it to charity is the right way of getting rid of it. And you can finally use that garage to house a new car or convert it into a new room for all your storage needs.

How Your Donation Helps

Last year, the American Kidney Fund provided direct financial assistance to 1 out of every 5 dialysis patients in all 50 states, the District of Columbia and every US territory. No other organization comes close to providing this scope of direct financial support to patients in need. This financial support is a lifeline, ensuring that patients can maintain access to lifesaving health care.

American Kidney Fund is the nations leading source of charitable assistance to dialysis patients in need, we help people fight kidney disease and live healthier lives.

Read Also: Can Seltzer Water Cause Kidney Stones

How Much Can You Claim As A Tax Deduction

Some vehicle donation programs claim that they offer the maximum tax deduction or are 100% tax deductible. In fact, the amount you may deduct is set by federal law, not controlled by the charity.

The IRS has established different rules for how much you may deduct for a vehicle donation depending on the value of the vehicle and whether the charity will sell the car or if it will keep and use the car as part of its charitable programs.

If the Charity Auctions Off or ScrapsYour Vehicle:

As noted above, some charities auction donated vehiclesor sell them to scrapyards. If this is what your charitydoes with your vehicle, then these IRS rules apply:

For vehicles with a claimed value of $500 or less, ataxpayer may deduct on his or her tax return the lesserof $500 or the vehicleâs fair market value. For example,if a vehicle has a fair market value of $450, the donorâscharitable contribution deduction may not exceed $450.

For vehicles with a claimed value of $500 or more, a taxpayer may only deduct on his or her tax return the lesser of the vehicleâs fair market value or the gross proceeds the charity receives from the sale of the vehicle. For example, if a donated vehicle has a fair market value of $900 but for whatever reason the charity receives only $750 in gross proceeds from its sale, the donorâs charitable contribution deduction may not exceed $750.

If the Charity Uses or Fixes Your Vehicle:

The charity may also do the following with your vehicle:

How Much Will My Tax Receipt Be

The way our program works is we act as the facilitator in coordinating all aspects of selling your vehicle to raise a charitable donation. By welcoming multiple charities to participate in our program, it gives you the opportunity to choose where you want your donation to go. It also opens doors for so many charities that would otherwise miss out on the opportunity to receive donated funds from generous people such as you.

Several programs that accept vehicles as a form of donation are very limited because they only have the ability to recycle vehicles. At Donate a Car Canada, we have two possible sale procedures that help us to maximize the highest donation amount possible for the charities.

The first way we can process your vehicle is through the use of our auction agents. There are many factors that go into qualifying a vehicle for sale by auction. These include but are not limited to: drivability, type of mechanical problems if any, age, damage, visual appearance, and odometer reading. If it is believed that your vehicle has adequate potential value for the auction sale process, this method would be utilized.

There isnt a hard and fast rule or an easy way to predict an auction value, especially when sales are as is. What we can tell you though, is that we have had donations as high as $29,000 as a result of our auction process, so there really arent limits when you are considering donating a vehicle.

You May Like: How To Report 401k Withdrawal On Tax Return

Read Also: How Much Money Is A Kidney Worth